The debtor needs to pay off the home loan cash on the due date. To appropriate such rental fees as well as profits in lieu of passion, or settlement of the home loan cash, or partially in payment of the mortgage money. The mortgagee does not have property of the residential property in this sort of home mortgage i.e. it gets only certified ownership which may cause absolute ownership in case of default by the mortgagee. With the modification in the provision, excellent focus is put on instilling the arrangement of repurchase in the initial sale deed itself as opposed to the deal being executed via 2 files. Where they are in separate documents the mortgagor after that the nature of purchase would not be a mortgage by conditional sale even if they are carried out concurrently.

- The 30-year, fixed-rate traditional home mortgage is the most preferred choice for buyers.

- You have to acquire a residence in a USDA-eligible location as well as satisfy particular earnings restrictions to qualify.

- You would certainly select the longer term when you require the lower payment or want more flexibility to pick when to repay the car loan.

- When your taken care of price offer involves an end, you will typically be instantly gone on to your lender's SVR.

- A fixed-rate home loan will mean your month-to-month repayments must stay the exact same until an arranged date, no matter what happens to rate of interest out there.

Some USDA loans do not need a deposit for eligible consumers with reduced earnings. There are additional charges, however, consisting of an in advance charge of 1 percent of the financing quantity and also an annual cost. If you have a strong credit report and can manage to make a large down payment, a conventional home loan is most likely your best pick. The 30-year, fixed-rate traditional home loan is the most popular choice for buyers.

Taken Care Of

We adhere to strict standards to make sure that our editorial web content is not influenced by advertisers. Our content team obtains no straight compensation from marketers, and also our material is completely fact-checked to make certain accuracy. So, whether you're reading a write-up or an evaluation, you can rely on that you're getting credible and also trustworthy info. For instance, if a private secures a $250,000 mortgage to purchase a residence, then the major finance amount is $250,000. A rate of interest refers to the amount billed by a lender to a customer for any type of kind of financial obligation given, generally shared as a percentage of the principal. Most home mortgages call for a deposit of around 10% to 20% of the residential property's value, but with typical home prices at around ₤ 250,000 this can be tough to discover.

Files Needed For A Home Loan Preapproval Letter: A Checklist

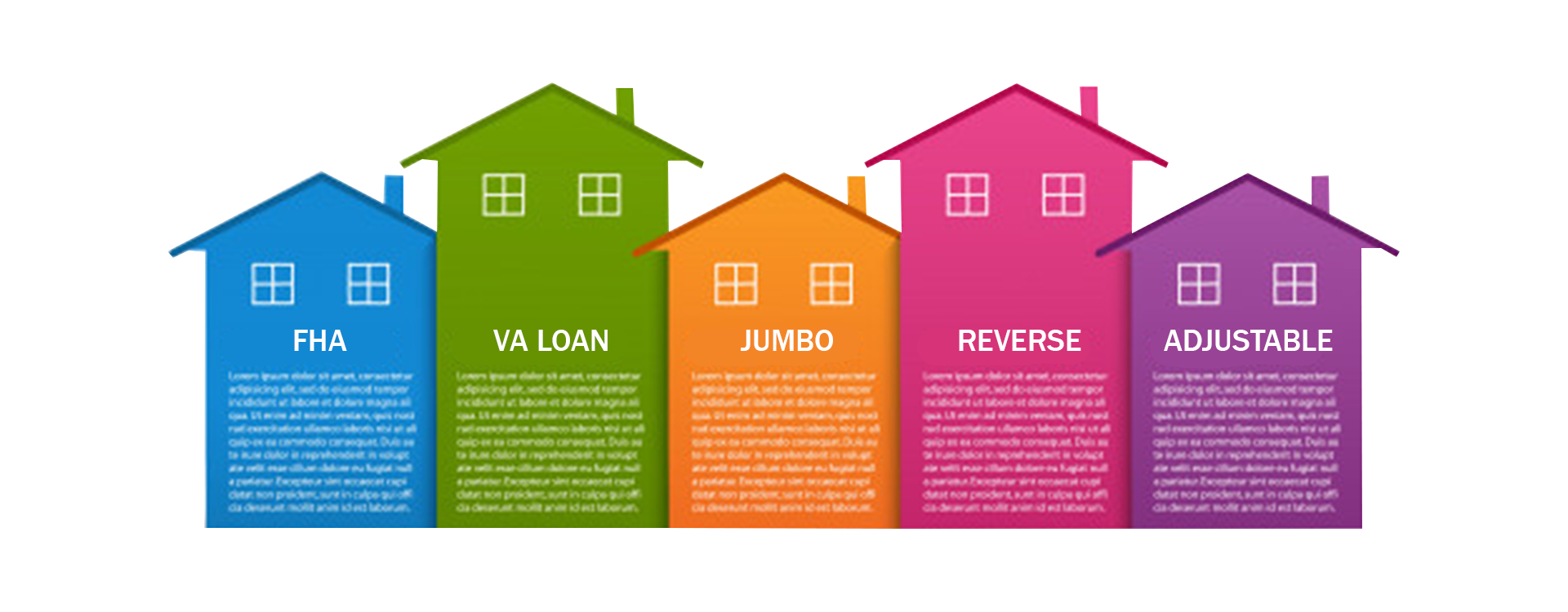

The residential or commercial property to be mortgaged need to be a particular one, i.e., It can be recognized by its dimension, place, borders, and so on. Income-qualified purchasers in rural and some suburban areas who want a reduced or no deposit. An FHA home mortgage is a home loan guaranteed by the Federal Housing Management. Use these calculators to see if you're monetarily all set to get. Your rate will certainly remain below your loan provider's SVR for the duration of the bargain. Check out the post right here View our brief video clip below for a quick explanation of each various kind of home mortgage as well as exactly how they work.

A rate of interest only home loan is a mortgage with which you just settle the passion owed each month, without making any type of payment in the direction of the quantity obtained. This indicates your home loan repayments will certainly be lower, yet that you will certainly require a big round figure to pay off the 'capital' or original time share vacation loan amount at the end of the term. The idea with rate of interest only home loans is as a result to have the amount you may usually pay for the mortgage conserved up in a different account, gaining passion. With a set price mortgage, your rates of interest is dealt with at a certain degree for a collection time period, typically between two and also one decade. People who prepare for a rise in income and a decline in the red in the future are decent prospects for a 15-year home mortgage. Once again, because deed back timeshare the finance term is shorter, the month-to-month repayment will certainly be more than it would certainly be with a 30-year alternative.