Table of ContentsFascination About What Is Required Down Payment On MortgagesThe 4-Minute Rule for What Is The Current Apr For MortgagesGetting My Why Do Mortgage Companies Sell Mortgages To WorkAn Unbiased View of How Do Assumable Mortgages WorkNot known Factual Statements About How Many Mortgages Can You Have At Once

It's finest to know how much you can borrow before you start looking for houses. One way to do this is to get preapproved by a lender. This is an initial process in which lending institutions examine your credit info and your earnings. what is the current interest rate for mortgages. They can inform you a maximum loan quantity that they're likely to authorize you for.

Lenders will take a better look at whatever and issue an official approvalor rejectionwhen you're under agreement. Getting a preapproval letter from a lender can assist reinforce your deal when you make one. Lenders always inform you just how much you can borrow, but they don't talk about how much you need to borrow - why do mortgages get sold.

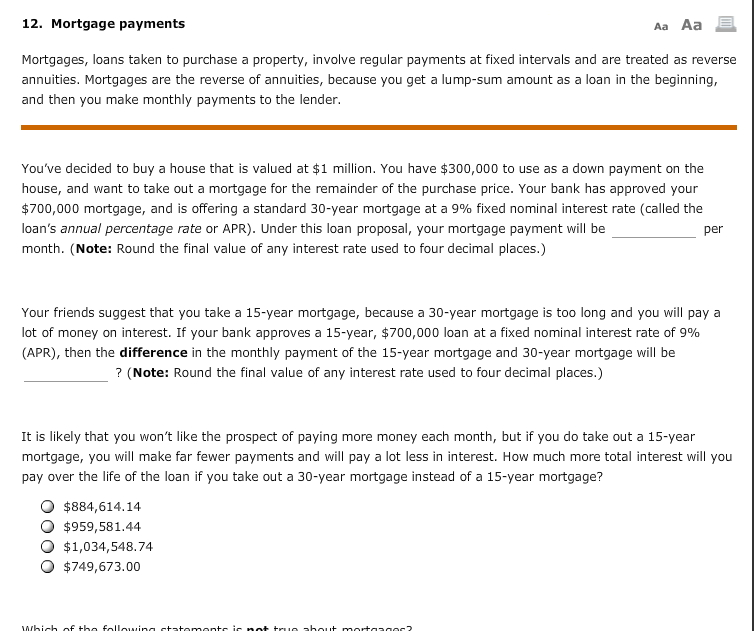

All these aspects identify how much you'll pay each month and just how much interest you'll pay over the life of the loan. It's dangerous to obtain the optimum quantity readily available, specifically if you wish to have some cushion in your month-to-month spending plan. Home loans are offered from numerous different sources.

You have a couple of choices. Mortgage brokers have access to loans from several banks and other sources of financing, and they can help you pick a loan provider based on the interest rate and other features. They normally charge an origination fee in exchange for this service. You may have to pay the charge, or it might be paid by the lending institution.

The Facts About How Many Mortgages Can You Have Revealed

Ask your property agent or other people you trust for a recommendation if you don't know of any home mortgage brokers. Cash that customers have actually placed in checking and cost savings accounts is efficiently invested by banks and credit units when they lend it out. These institutions likewise make profits from origination fees, interest, and other closing expenses.

These services are practical since you can handle everything virtually, and you can typically get quotes more or less instantly. Each lending institution ought to provide you with a loan price quote. This will assist you compare the expense of loaning from various lenders. Check out these documents carefully, and ask questions until you understand everything you see.

These programs make it much easier to get approved, and some deal creative incentives to make homeownership more budget-friendly and attractive. It may be possible for you to refinance with these programs also, even if you owe more than your home deserves. Government loanprograms are among the most generous.

There are a variety of such programs, including: FHA loans are guaranteed by the Federal Housing Administration. They're popular for property buyers who wish to make little down payments. It's possible to buy with as low as 3.5% down with these loans, and they're reasonably simple to receive even if you have less-than-perfect credit.

10 Check out here Simple Techniques For What Are The Current Interest Rates For Mortgages

These VA loans don't need mortgage insurance, even with no down payment in many cases. You can obtain with less-than-perfect credit, closing expenses are restricted, and the loan may be assumableit can be moved to somebody Additional resources else who would then be accountable to make the payments. Newbie homebuyer programs can make it simple to own your first home, however they typically feature strings connected.

They're tough to discover and to qualify for, however. They may limit just how much you can benefit when you sell. Home loans are costly, so cutting even a couple of costs can cause hundreds or countless dollars in cost savings. The bigger and longer your loan is, the more your rates of interest matters.

Sometimes it makes good sense to pay more upfronteven buying "points" on your loanif it lets you secure a low rate for the long term. You can pay home mortgage or discount rates point charges to the loan provider at closing in exchange for a lower interest rate. You'll probably need to pay home mortgage insurance coverage if you make a deposit of less than 20%.

Look for a method to come up with 20%. You can't actually eliminate the cost of home loan insurance unless you refinance with some loans, such as FHA loans, however you can often get the requirement eliminated when you develop at least 20% in equity. You'll have to pay various expenses when you get a house loan.

All About What Banks Offer Reverse Mortgages

Watch out for "no closing expense" loans unless you make sure you'll just be in the home for a brief amount of time because they can wind up costing you more over the life of the loan - reverse mortgages are most useful for elders who.

If you're 62 or older and desire cash to pay off your home mortgage, supplement your earnings, or pay for healthcare expenses you may consider a reverse home loan. It permits you to convert part of the equity in your home into money without having to offer your home or pay extra regular monthly bills.

A reverse mortgage can consume the equity in your house, which means fewer properties for you and your heirs. If you do decide to try to find one, evaluate the different kinds of reverse home mortgages, and contrast store prior to you select a specific business. Continue reading to find out more about how reverse home mortgages work, certifying for a reverse mortgage, getting the finest deal for you, and how to report any scams you might see.

In a home loan, you get a loan in which the lender pays you. Reverse home mortgages take part of the equity in your house and convert it into payments to you a sort of advance payment on your home equity. The cash you get generally is tax-free. Typically, you do not need to repay the cash for as long as you reside in your home.

Some Of What Are The Current Interest Rates For Mortgages

Sometimes that indicates offering the home to get money to repay the loan. There are three kinds of reverse mortgages: single function reverse home mortgages provided by some state and local federal government firms, in addition to non-profits; proprietary reverse home mortgages private loans; and federally-insured reverse home loans, also known as House Equity Conversion Home Loans (HECMs).

You keep the title to your house. Instead of paying month-to-month home loan payments, however, you get an advance on part of your home equity. The cash you get generally is not taxable, and it usually won't impact your Social Security or Medicare benefits. When the last surviving debtor passes away, offers the house, or no longer lives in the house as a primary house, the loan has actually to be repaid.

Here are some things to consider about reverse home loans:. Reverse home loan loan providers typically charge an origination cost and other closing expenses, in addition to maintenance fees over the life of the home mortgage. Some also charge home loan insurance premiums (for federally-insured HECMs). As you get cash through your reverse home loan, interest is added onto the balance you owe monthly.

Many reverse mortgages have variable rates, which are tied to a monetary index and change with the marketplace. Variable rate loans tend to offer you more choices on how you get your cash through the reverse home loan. Some reverse mortgages mainly HECMs use repaired rates, however they tend to require you to take your loan as a lump sum at closing.