Table of ContentsIndicators on Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages? You Should KnowGetting The How Do Lenders Make Money On Reverse Mortgages To WorkNot known Incorrect Statements About Which Type Of Interest Is Calculated On Home Mortgages The Best Guide To What Does It Mean When Economists Say That Home Buyers Are "Underwater" On Their Mortgages?Top Guidelines Of How Often Are Mortgages Compounded

Due to the fact that ownership changes two times in an https://zenwriting.net/branya0aog/your-payment-will-increase-if-rates-of-interest-increase-however-you-may-see Islamic mortgage, a stamp tax might be charged twice. Many other jurisdictions have comparable transaction taxes on modification of ownership which may be imposed. In the UK, the dual application of stamp responsibility in such deals was removed in the Finance Act 2003 in order to help with Islamic home loans. There are a number of kinds of home mortgages offered to consumers. They consist of traditional fixed-rate mortgages, which are among the most common, in addition to variable-rate mortgages (ARMs), and balloon mortgages. Potential homebuyers ought to research the right option for their needs. The name of a home mortgage normally shows the way interest accumulates.

Fixed-rate home loans are readily available in terms ranging approximately thirty years, with the 30-year choice being the most popular, says Kirkland. Paying the loan off over a longer time period makes the monthly payment more cost effective. However no matter which term you prefer, the rates of interest will not alter for the life of the home mortgage.

Under the regards to an variable-rate mortgage (ARM), the interest rate you're paying might be raised or decreased regularly as rates change. ARMs might a great idea when their interest rates are particularly low compared to the 30-year repaired, especially if the ARM has a long fixed-rate duration prior to it begins to change." Some examples of a variable-rate mortgage would be a 5/1 ARM and or a 7/1 ARM," stated Kirkland.

Under the regards to a balloon mortgage, payments will start low and then grow or "balloon" to a much larger lump-sum amount prior to the loan ends. This type of mortgage is typically focused on buyers who will have a greater earnings towards completion of the loan or loaning duration then at the outset.

The How Do Adjustable Rate Mortgages Work Statements

For those who don't intend to sell, a balloon home loan may require refinancing in order to remain in the property." Buyers who choose a balloon home loan may do so with the intention of re-financing the mortgage when the balloon mortgage's term runs out," states Pataky "General, balloon home loans are one of the riskier kinds of home mortgages." An FHA loan is a government-backed home mortgage insured by the Federal Housing Administration." This loan program is popular with many novice homebuyers," states Kirkland.

The VA loan is a loan ensured by the U.S. Department of Veterans Affairs that needs little or no cash down. It is available to veterans, service members and qualified military partners. The loan itself isn't really made by the government, but it is backed by wes phone number usa a federal government agency, which is created to make lending institutions feel more comfy in using the loan.

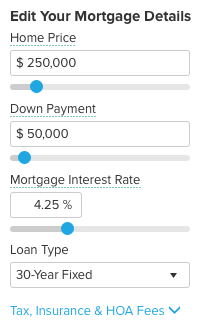

It is essential to comprehend as you buy a home mortgage that not all home loan products are developed equivalent, so doing your research is vital, says Kirkland." Some have more stringent guidelines than others. Some lenders might require a 20 percent down payment, while others require as low as 3 percent of the house's purchase cost," he says.

In addition to understanding the various home mortgage products, invest some time searching with different loan providers." Even if you have a favored lending institution in mind, go to 2 or 3 lendersor even moreand make sure you're totally surveying your choices," states Pataky of TIAA Bank. "A tenth of a percent on rates of interest might not seem like a lot, but it can translate to countless dollars over the life of the loan. why do mortgages get sold.".

Rumored Buzz on Why Reverse Mortgages Are A Bad Idea

A home loan is essentially a loan to assist you buy a property (how reverse mortgages work). You'll generally require to put down a deposit for a minimum of 5% of the home value, and a home loan allows you to obtain the rest from a lender. You'll then pay back what you owe monthly, typically over a duration of several years.

You'll generally pay interest on the quantity borrowed each month too, either at a fixed or variable interest rate, depending on which type of deal you select. The loan is secured versus your property up until it has been paid back in complete. The amount of interest you'll pay on your mortgage depends upon the mortgage offer you've selected.

When the repaired rate duration ends, you'll typically be automatically moved onto your lending institution's standard variable rate, which will normally be higher than any unique offer you've been on (what are reverse mortgages). At this moment you'll see your interest payments increase. Nevertheless, you will be free to remortgage to a new mortgage offer, which might help keep your payments down.

If rate of interest fall then this drop could be handed down to you, and you will see your monthly payments decrease as an outcome. If mortgage rates increase however, then borrowing expenses end up being steeper for lending institutions, and these greater costs are normally passed onto homeowners. In this case your regular monthly payments would go up.

Examine This Report about What Are Jumbo Mortgages

In the early years of your home loan, a larger proportion of your regular monthly payment goes towards settling your interest, and a smaller sized quantity towards your capital. Gradually, you'll start to pay off more of your capital with time as your debt minimizes. When you sell your property or move house, you'll generally have various different mortgage choices offered.

Nevertheless, you will successfully have to request your home mortgage once again, so you'll require to please your lending institution that month-to-month payments remain affordable. It'll be down to them to choose whether they enjoy to allow you to move your present deal over to your new property. Bear in mind too that there might be fees to spend for moving your mortgage.

Keep in mind, nevertheless, that if you do this, any extra borrowing might be at a different rate. If you're not tied into your existing mortgage offer and there aren't any early payment charges to pay if you leave it, you might remortgage with a various lender for the amount you need for your new home.

Providing requirements is much stricter now than it was a few years back, and lending institutions Look at this website will generally desire to go through your financial resources with a fine toothcomb to examine you can handle the month-to-month payments before they'll provide you a home mortgage. If there's going to be a space between the sale of your house and the purchase of your brand-new property, some individuals look for what's referred to as a 'swing loan' to bridge this space.

See This Report on Which Fico Score Is Used For Mortgages

Nevertheless, these must just be thought about a last resort as they generally extremely high rates of interest and fees. Seek professional advice if you're unsure, and if you're considering this type of loan you need to be comfy with the risks involved as you'll essentially own two homes for an amount of time.

Your principal and interest payment is only part of what you'll pay. Most of the times, your payment includes an escrow for real estate tax and insurance coverage. That means the home mortgage company gathers the cash from you, holds onto it, and makes the proper payments when the time comes. Lenders do that to safeguard themselves.